It’s hard to tell how you are getting good legal work done for your money in transactional legal matters. Just like it is hard to tell if you are seeing a medical practitioner / doctor. Sometimes only other doctors know if a certain doctor is a good one. The same applies in the selection of an attorney. Attorneys know of one another and they know the good ones. But how does a lay person, non-attorney know? It’s difficult to tell from just asking Google! Often lessons are learned the hard way but our wish is to prepare you, to guide you through selecting the right and trustworthy estate planning attorney to prepare and protect you and your family. To understand the importance of estate planning, read more

here.

Here are some thoughts and tips if you are working with a good estate planning attorney in no particular order:

- You understand what you are signing.

- A good attorney explains in lay man’s (simple) terms what you are signing, reviews each document with you, points out the key provisions of each document and asks you to check names and spellings and other information that is unique to you.

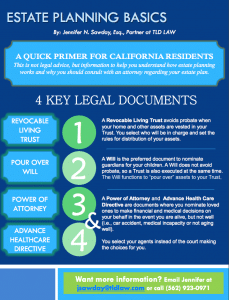

- The durable power of attorney is not just a two page standard “check the box” power of attorney that looks like it was downloaded from the internet.

- A well drafted power of attorney should be at least 20 pages long and detail all the powers the person is giving to the agent. The power of attorney should name someone to act as agent and ought to have one or two more back up agents. The power of attorney should also be clear when it is effective. Some are effective immediately while others are effective upon incapacity.

- The Advance Health Care Directive was not downloaded from a medical website and is a form that has fill in the blanks.

- An attorney should not use these downloadable forms for their estate planning documents – they should take the care to draft proper legal documents to assist with your estate planning goals. Does your advance health care directive have language to allow your agents to access your private health information under HIPAA and/CMIA – these are laws that restrict access to your medical files.

- Your Trust should have a fully completed Schedule A.

- The Schedule A is a separate document from the Trust and provides a listing of your real estate and other financial assets so the trustee knows what belongs in the trust and where to go when you pass away.

- If you have a Trust, you should have a companion or back up Will called a Pour-Over Will.

- The Pour-Over Will is designed to be a back up in case you have newly acquired assets or something was not properly in your Trust when you pass away. In most cases, a Pour-Over Will is never used when a Trust is created and properly funded.

- The attorney should prepare and RECORD all California real estate into your Trust for you.

- There’s nothing worse than seeing a signed Trust Transfer Deed that is among the documents but was never recorded. A good attorney will prepare the Trust Transfer Deeds and cause them to be recorded. Once recorded, the Trust Transfer Deeds should be mailed back to you and kept with your Trust. This is how real estate gets vested or transferred into your Trust to avoid probate.

- Your Trust should make sense at least as to Successor Trustees and the Distribution Provisions.

- You should be able to read these two sections and tell who will be in charge as a successor trustee when you die and what rules you have set up for the distribution of the trust assets for your beneficiaries.

This is a small list, but it is a good place to start to see if you have quality estate planning documents. Â TLD Estate Planning Attorney

Jen Sawday is always willing to consult to review

existing estate planning documents and see if they meet the test! She can be reached at

[email protected].